In today’s digital age, where online security breaches are rampant, safeguarding customer information and ensuring secure transactions have become paramount for businesses. Among the various security measures available, SMS One-Time Password (OTP) stands out as a reliable method for authenticating users and protecting sensitive data. This article delves into the significance of SMS OTP and why businesses need to implement it for their customers.

Introduction to SMS OTP

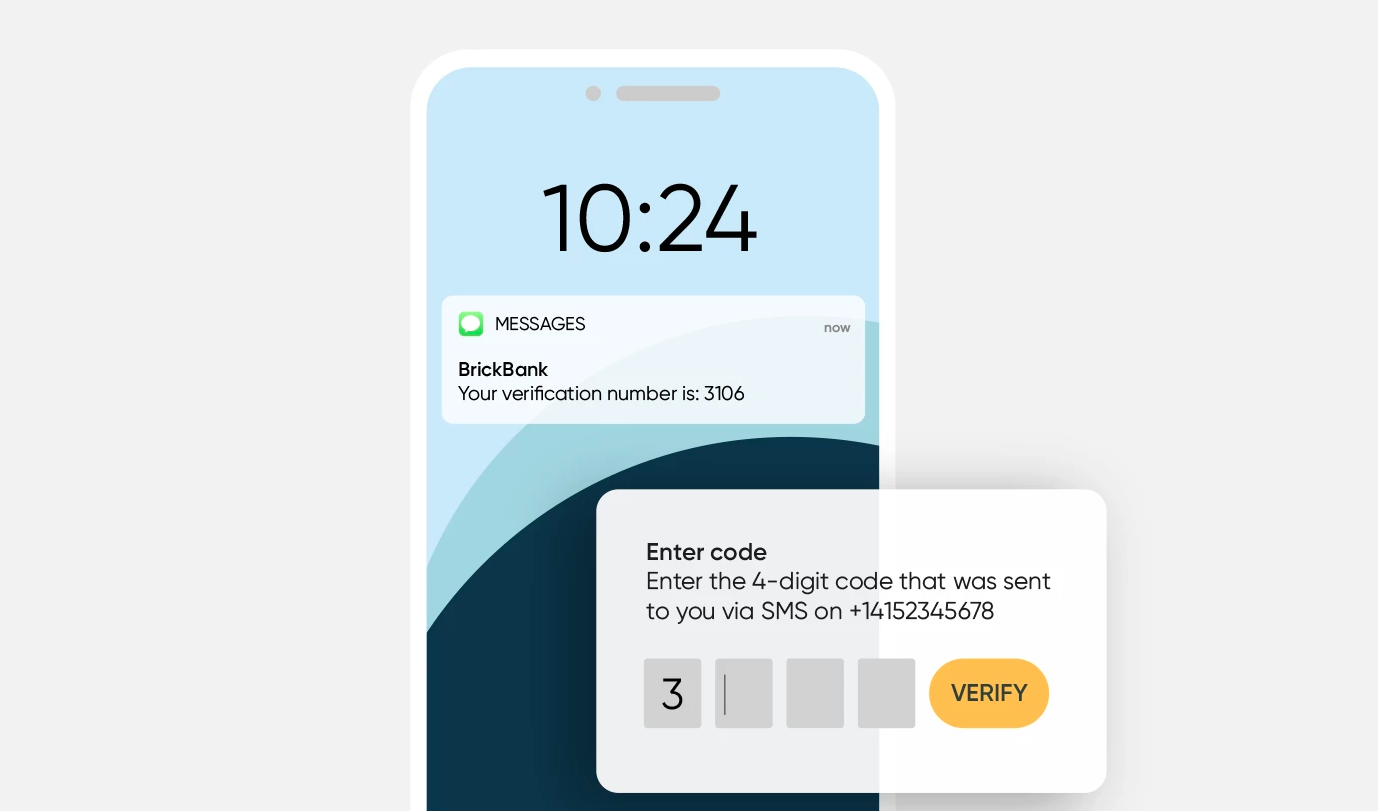

SMS OTP, or Short Message Service One-Time Password, stands as a pivotal security measure in modern authentication protocols. Its implementation introduces an additional layer of protection crucial in safeguarding sensitive information and user identities against various forms of cyber threats. This method operates by delivering a unique, time-sensitive code to the user’s mobile device through SMS, compelling users to input the provided code to confirm their identity and gain access to secure systems or services.

The rise of identity theft, account takeover fraud, and unauthorized access to personal and confidential data have underscored the importance of robust security mechanisms. SMS OTP addresses these concerns by introducing a dynamic element that enhances the verification process beyond traditional username-password combinations. Its reliance on mobile phones, which have become ubiquitous in today’s digital landscape, ensures widespread accessibility and ease of use across diverse user demographics.

One of the primary strengths of SMS OTP lies in its simplicity and ease of implementation. Unlike more complex authentication methods, SMS OTP requires minimal infrastructure and technical expertise to deploy, making it accessible to organizations of varying sizes and resource levels. Furthermore, its familiarity with users mitigates resistance to adoption and facilitates seamless integration into existing workflows and applications.

The effectiveness of SMS OTP hinges on the ephemeral nature of the generated codes. Each code is valid for only a short duration, typically ranging from a few minutes to several hours, thereby reducing the window of opportunity for malicious actors to intercept and exploit the authentication process. This time-bound characteristic enhances the security posture of systems and bolsters confidence among users regarding the integrity of their digital interactions.

However, while SMS OTP offers significant advantages in terms of security and usability, it is not immune to certain vulnerabilities. Instances of SIM swapping, SMS interception, and phishing attacks pose persistent challenges to the integrity of SMS-based authentication mechanisms. As such, organizations must complement SMS OTP with additional layers of security, such as biometric authentication, device fingerprinting, and behavioral analytics, to fortify their defense against evolving threats.

Understanding the Concept of OTP

One-time passwords (OTPs) stand as stalwarts in the realm of cybersecurity, fortifying authentication mechanisms with an additional layer of defense. Akin to a sentinel at the gate, an OTP is a solitary code, fleeting yet formidable, designated for a singular use within a specific transaction or login session. Its transient nature imbues it with a unique prowess, rendering it obsolete once its purpose has been served.

The essence of an OTP lies in its dynamic generation, ensuring that each code is ephemeral and unpredictable. This unpredictability serves as a bulwark against the perils of static passwords, thwarting the advances of malevolent actors who seek unauthorized access to sensitive systems or data.

The methodologies for generating OTPs span a diverse spectrum, catering to the multifaceted landscape of modern technology. SMS, venerable yet resilient, delivers OTPs directly to user’s mobile devices, leveraging the ubiquity of text messaging infrastructure. Email, a stalwart of digital communication, extends its reach to deliver OTPs to users’ inboxes, offering a seamless integration into existing workflows.

Hardware tokens, epitomizing security through tangible means, generate OTPs within compact devices, impervious to the vulnerabilities of software-based solutions. Mobile apps, harnessing the power of smartphones, provide a versatile platform for OTP generation, marrying convenience with robustness in the palm of one’s hand.

The adoption of OTPs epitomizes a paradigm shift towards proactive cybersecurity measures, transcending the confines of traditional password-based authentication. By augmenting conventional login credentials with dynamically generated codes, organizations fortify their defenses against an ever-evolving landscape of cyber threats.

Yet, amidst the allure of OTPs lies a caveat – the imperative of implementation with prudence and foresight. Challenges such as phishing attacks, SIM swapping, and device theft underscore the necessity for a comprehensive approach to security, encompassing not only the strength of OTPs but also the integrity of the systems that administer them.

In the crucible of modern cybersecurity, OTPs emerge as stalwarts of authentication, their transient potency serving as a bulwark against the tides of digital malevolence. As guardians of access and sentinels of security, they epitomize the ethos of resilience in an age defined by perpetual innovation and relentless adversity.

The Role of SMS OTP in Customer Authentication

Customer authentication is a crucial process employed by online services to ensure the security and integrity of user accounts and transactions. At its core, authentication involves verifying the identity of individuals before granting them access to sensitive information or allowing them to perform certain actions. Among the various methods used for customer authentication, SMS OTP (Short Message Service One-Time Password) stands out as a reliable and widely adopted approach.

SMS OTP works by delivering a unique, one-time code to the user’s mobile device. This code serves as a second factor of authentication, supplementing traditional username and password combinations. When a user attempts to log in or perform a sensitive transaction, they are prompted to enter the OTP received via SMS. Only after successfully providing the correct OTP can the user gain access or complete the transaction.

The effectiveness of SMS OTP lies in its simplicity and accessibility. Virtually all mobile devices, including smartphones and basic feature phones, are capable of receiving SMS messages, making this method widely available to users across various demographics. Additionally, SMS OTP does not require users to install specialized authentication apps or hardware tokens, further lowering barriers to adoption.

Furthermore, SMS OTP offers a high level of security. Each OTP is generated for a specific transaction or login attempt and is only valid for a short period, typically a few minutes. This time-bound nature mitigates the risk of unauthorized access in case the OTP is intercepted or stolen. Moreover, the delivery of OTPs via SMS adds an extra layer of protection, as it requires possession of the user’s registered mobile device to receive the code.

Despite its effectiveness, SMS OTP is not without limitations. One notable concern is the potential vulnerability to SMS interception techniques, such as SIM swapping or phishing attacks targeting mobile carriers. Additionally, reliance on SMS delivery may pose challenges in regions with unreliable cellular network coverage or where users incur additional charges for receiving text messages.

Advantages of Using SMS OTP for Customers

SMS One-Time Password (OTP) authentication offers numerous advantages to customers, enhancing accessibility and ease of use in securing online accounts. Unlike hardware tokens or biometric authentication methods, SMS OTP eliminates the need for additional hardware or specialized software. Its simplicity lies in the fact that users can receive OTPs on any mobile device equipped with SMS capabilities, thereby fostering convenience and user-friendliness.

The accessibility of SMS OTP is unparalleled. In a world where mobile phones are ubiquitous, virtually every individual possesses a device capable of receiving SMS messages. This universality ensures that customers can access OTPs regardless of their location or the type of mobile device they use. Unlike hardware tokens, which individuals may misplace or forget to carry, SMS OTP leverages a platform already integrated into daily life.

Furthermore, the ease of use associated with SMS OTP simplifies the authentication process for users. Upon initiating a login attempt or a transaction requiring verification, users receive a unique OTP via SMS almost instantaneously. This swift delivery minimizes waiting times and streamlines the authentication process, enhancing user experience.

Moreover, SMS OTP implementation is relatively straightforward for businesses, requiring minimal infrastructure or integration efforts. Unlike complex biometric systems, which demand specialized hardware and software, SMS OTP relies on existing telecommunications infrastructure. This simplicity reduces implementation costs and enables businesses to deploy OTP authentication swiftly and efficiently.

The security of SMS OTP, while effective, warrants consideration. While it provides an additional layer of security compared to static passwords, SMS OTPs are not immune to interception or SIM-swapping attacks. Consequently, businesses must employ additional security measures, such as encryption and fraud detection algorithms, to mitigate these risks effectively.

Security Aspects of SMS OTP

SMS One-Time Password (OTP) authentication serves as a crucial security measure, safeguarding against unauthorized access to accounts. However, despite its efficacy, SMS OTP is not impervious to vulnerabilities and risks inherent in digital communication channels. Cybercriminals continually devise sophisticated methods to exploit weaknesses in SMS infrastructure, compromising OTP verification processes and posing significant threats to users and businesses alike.

One prevalent risk associated with SMS OTP is message interception. Cyber attackers employ various techniques, such as SIM swapping or SMS interception malware, to intercept OTPs sent via SMS. By gaining unauthorized access to a user’s mobile device or intercepting SMS traffic, attackers can obtain OTPs compromise sensitive accounts, or conduct fraudulent transactions.

Moreover, phishing attacks represent another formidable threat to SMS OTP security. Cybercriminals often employ social engineering tactics to deceive users into divulging OTPs or sensitive information under pretenses. Through fraudulent emails, text messages, or websites designed to mimic legitimate sources, attackers exploit human vulnerabilities to trick users into disclosing OTPs, thereby circumventing authentication measures.

Furthermore, weaknesses in the SMS infrastructure itself can pose significant security risks. Vulnerabilities in mobile networks or SMS gateways may enable attackers to intercept, manipulate, or reroute SMS messages containing OTPs. Additionally, SMS delivery delays or failures could inadvertently expose users to security breaches or disrupt the authentication process, undermining the reliability of OTP verification.

To mitigate these risks effectively, businesses must implement robust security measures tailored to address the vulnerabilities associated with SMS OTP authentication. Encryption protocols, such as end-to-end encryption and secure communication channels, can enhance the confidentiality and integrity of OTP transmissions, thwarting interception attempts by malicious actors.

Furthermore, adopting multi-factor authentication (MFA) mechanisms can augment SMS OTP security by requiring additional verification factors beyond SMS codes. Integrating biometric authentication, hardware tokens, or authenticator apps strengthens authentication processes, reducing reliance solely on SMS OTPs and mitigating the impact of potential vulnerabilities.

Additionally, leveraging device fingerprinting techniques enables businesses to authenticate users based on unique device identifiers, enhancing security and detecting suspicious activities or unauthorized access attempts.

Regulatory Compliance and SMS OTP

In the contemporary landscape of data privacy regulations, businesses face heightened scrutiny regarding the handling of customer data, particularly when implementing SMS One-Time Password (OTP) authentication systems. Stringent laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, impose rigorous requirements on businesses to ensure the protection of customer data and uphold privacy rights. Compliance with these regulations is paramount for businesses leveraging SMS OTP to maintain trust and avoid legal repercussions.

The GDPR, enacted by the European Union, sets forth comprehensive guidelines for the collection, processing, and storage of personal data of EU citizens. Under the GDPR, businesses must obtain explicit consent from individuals before processing their data, including mobile phone numbers used for SMS OTP delivery. Additionally, businesses must implement robust security measures to prevent unauthorized access to customer data and promptly report data breaches to regulatory authorities and affected individuals.

Similarly, the CCPA, enacted in California, grants consumers extensive rights regarding the control and protection of their personal information. Businesses subject to the CCPA must disclose their data collection practices, allow consumers to opt out of the sale of their personal information, and ensure the security of data transmitted via SMS OTP. Non-compliance with the CCPA can result in substantial fines and reputational damage to businesses found in violation of its provisions.

When implementing SMS OTP, businesses must prioritize data privacy and adopt measures to ensure compliance with regulatory requirements. This includes implementing data encryption protocols to safeguard sensitive information transmitted via SMS, such as OTP codes and user credentials. Furthermore, businesses must maintain clear and transparent privacy policies that outline how customer data, including SMS OTP-related information, is collected, processed, and protected.

Moreover, businesses should regularly audit their SMS OTP systems and practices to identify and address any potential compliance gaps or security vulnerabilities. This proactive approach demonstrates a commitment to data privacy and helps mitigate the risk of regulatory penalties and legal liabilities.

Implementing SMS OTP for Customer Engagement

Integrating SMS One-Time Password (OTP) into existing systems and platforms necessitates meticulous planning and execution. Businesses recognize the importance of customizing OTP messages not only to enhance brand identity but also to bolster customer engagement. With seamless and secure authentication experiences, businesses can cultivate trust with their customers, fostering enduring relationships.

The integration of SMS OTP entails several crucial considerations. Firstly, businesses must assess their existing infrastructure and determine the most compatible OTP solution. Whether through in-house development or third-party providers, selecting a solution that aligns with the organization’s technical requirements and scalability is paramount.

Customization of OTP messages presents an opportunity for businesses to reinforce brand identity. By incorporating company logos, slogans, or personalized greetings, businesses can infuse their unique brand voice into the authentication process. This not only strengthens brand recognition but also cultivates a sense of familiarity and trust with customers.

Moreover, customized OTP messages can enhance customer engagement. Beyond the standard verification code, businesses can include promotional offers, product updates, or links to relevant content within OTP messages. This proactive approach not only adds value to the authentication process but also encourages customers to actively engage with the brand.

However, while customization offers numerous benefits, businesses must balance branding efforts with the clarity and brevity of OTP messages. Clear instructions and concise messaging ensure that customers can swiftly complete the authentication process without confusion or frustration.

In addition to enhancing brand identity and customer engagement, SMS OTP integration plays a crucial role in strengthening security measures. By implementing multi-factor authentication (MFA), businesses add an extra layer of protection against unauthorized access and fraudulent activities. SMS OTP serves as a reliable method for verifying the identity of users, mitigating the risk of data breaches and identity theft.

Ultimately, the successful integration of SMS OTP requires a strategic approach that prioritizes both security and user experience. By offering seamless authentication experiences while reinforcing brand identity, businesses can instill confidence in their customers and foster long-term relationships built on trust and reliability.

Case Studies: Successful Implementation of SMS OTP

Numerous businesses have adeptly integrated SMS One-Time Password (OTP) solutions to fortify security measures and optimize customer interactions. Among these, financial institutions stand out for leveraging SMS OTP to authenticate online transactions and thwart fraudulent activities. Similarly, e-commerce platforms have embraced SMS OTP to bolster user account security and shield sensitive information. These case studies underscore the efficacy of SMS OTP in safeguarding customer data and curbing unauthorized access.

In the realm of financial services, SMS OTP serves as a cornerstone of transaction security. Banks and other financial institutions routinely deploy SMS OTP to verify the authenticity of online transactions initiated by customers. By sending a unique, time-sensitive code to the customer’s registered mobile device, banks ensure that only authorized users can complete transactions, thus mitigating the risk of unauthorized access and fraudulent activities. This proactive approach not only safeguards customer assets but also fosters trust and confidence in online banking services.

Similarly, e-commerce platforms have embraced SMS OTP as a robust authentication mechanism to safeguard user accounts and sensitive information. Upon account creation or when initiating critical actions such as password resets or payment confirmations, e-commerce platforms dispatch SMS OTPs to users’ mobile phones. This additional layer of authentication adds a vital safeguard against unauthorized access and malicious activities, bolstering user trust and confidence in the platform’s security measures.

The effectiveness of SMS OTP lies in its simplicity and reliability. Unlike traditional password-based authentication methods, SMS OTPs offer a dynamic and time-bound verification mechanism that significantly reduces the risk of unauthorized access and data breaches. Furthermore, the ubiquity of mobile devices ensures that SMS OTPs are accessible to a vast majority of users, making them an inclusive and user-friendly security solution.

Moreover, the implementation of SMS OTP underscores businesses’ commitment to data security and customer privacy. By prioritizing robust authentication mechanisms, businesses demonstrate their dedication to safeguarding customer data and preventing security breaches. This proactive stance not only enhances brand reputation but also cultivates long-term customer loyalty and trust.

Challenges and Limitations of SMS OTP

SMS One-Time Password (OTP) authentication has long been a staple in digital security protocols due to its effectiveness in verifying user identities. However, its widespread use also brings attention to its inherent limitations and challenges. One primary concern revolves around the reliability of SMS delivery, especially in areas with poor network coverage or during periods of high traffic congestion.

In regions where network infrastructure is lacking or during peak hours, SMS delivery can experience delays or disruptions, causing inconvenience and frustration for users attempting to access online services. This unreliability not only compromises user experience but also undermines the security of the authentication process, leaving systems vulnerable to exploitation during periods of downtime or network instability.

Furthermore, the reliance on SMS OTP authentication assumes that users have access to mobile devices capable of receiving text messages. While smartphones are ubiquitous in many parts of the world, there are still segments of the population that may not own or regularly use such devices. Additionally, some users may be hesitant to share their mobile phone numbers due to privacy concerns or may encounter difficulties receiving SMS messages due to technical issues or carrier restrictions.

To address these challenges and ensure a seamless user experience, businesses, and service providers must explore alternative authentication methods that offer greater reliability and accessibility. One such approach involves implementing app-based OTP authentication, where users receive one-time codes through dedicated mobile applications rather than relying on SMS delivery. App-based authentication not only eliminates the dependency on cellular networks but also provides additional security features such as device fingerprinting and biometric verification.

Moreover, businesses can leverage emerging technologies such as biometric authentication, multi-factor authentication (MFA), and hardware security tokens to augment existing authentication mechanisms and enhance overall security posture. By diversifying authentication methods and prioritizing user experience, organizations can mitigate the limitations associated with SMS OTP authentication while maintaining robust security standards.

Also read: SMS Sender ID: Enhancing Communication Efficiency

Future Trends and Innovations in SMS OTP

As technology advances, the landscape of online security continues to evolve, prompting the development of innovative methods to safeguard transactions and protect user identities. While SMS One-Time Password (OTP) authentication has been a stalwart in the realm of digital security, emerging technologies present promising avenues for enhancing its effectiveness and resilience against cyber threats.

One such technology is biometric authentication, which utilizes unique biological traits such as fingerprints, iris patterns, or facial recognition to verify user identities. Unlike traditional authentication methods reliant on passwords or OTPs, biometric authentication offers a higher level of security and user convenience, eliminating the need to remember complex passwords or input OTPs. By integrating biometric authentication with SMS OTP, businesses can enhance the security of online transactions while streamlining the user authentication process.

Tokenization is another emerging technology poised to revolutionize online security measures. Tokenization involves substituting sensitive data such as credit card numbers or personal identification information with unique tokens, rendering them meaningless to unauthorized parties. By implementing tokenization techniques in conjunction with SMS OTP authentication, businesses can mitigate the risk of data breaches and unauthorized access, safeguarding sensitive information transmitted during online transactions.

Blockchain technology, renowned for its decentralized and immutable nature, offers yet another layer of security for SMS OTP authentication. By leveraging blockchain-based authentication protocols, businesses can establish tamper-resistant records of user authentication attempts, enhancing transparency and accountability in the authentication process. Blockchain technology also mitigates the risk of single points of failure associated with centralized authentication systems, thereby bolstering the reliability and resilience of SMS OTP authentication.

Innovations in encryption algorithms and authentication protocols play a pivotal role in fortifying the security of SMS OTP against evolving cyber threats. Advanced encryption standards and robust authentication mechanisms help safeguard sensitive information transmitted during OTP generation and verification processes, reducing the likelihood of interception or unauthorized access by malicious actors.

As the digital landscape continues to evolve, businesses must remain vigilant in adopting and adapting to emerging technologies to stay ahead of cyber threats. By embracing biometric authentication, tokenization, blockchain-based authentication, and advancements in encryption algorithms, businesses can fortify the security and reliability of SMS OTP authentication, ensuring the integrity of online transactions and protecting user identities in an increasingly interconnected world.

Conclusion

In conclusion, SMS One-Time Password (OTP) authentication stands as a cornerstone in the modern digital landscape, playing a vital role in enhancing security measures and safeguarding customer information. Its widespread adoption across various industries underscores its significance as a fundamental component of authentication mechanisms employed by businesses worldwide. By implementing SMS OTP, organizations not only bolster their security posture but also instill trust and confidence among their customer base.

The importance of SMS OTP lies in its ability to provide an additional layer of security against unauthorized access and fraudulent activities. By requiring users to authenticate themselves through a unique, time-sensitive code delivered via SMS, businesses can effectively verify the identity of individuals attempting to access their online platforms or conduct transactions. This verification process serves as a deterrent to malicious actors seeking to exploit vulnerabilities within digital systems, thereby mitigating security risks and protecting sensitive customer data from unauthorized disclosure or misuse.

Furthermore, SMS OTP plays a crucial role in helping businesses comply with regulatory requirements and industry standards governing data security and privacy. With the increasing emphasis on regulatory compliance, particularly in sectors handling sensitive information such as financial services and healthcare, the adoption of robust authentication measures like SMS OTP is imperative for organizations seeking to uphold regulatory mandates and safeguard the integrity of customer data.

As technology continues to advance, SMS OTP remains adaptable and resilient, evolving alongside emerging threats and evolving security challenges. While alternative authentication methods such as biometric authentication and tokenization offer additional layers of security, SMS OTP retains its relevance and efficacy as a cost-effective and widely accessible authentication solution for businesses of all sizes. Its simplicity and ease of implementation make it an attractive choice for organizations seeking to balance security requirements with user experience considerations.

Looking ahead, SMS OTP is poised to remain a key component of multifactor authentication strategies employed by businesses across diverse industries. As cyber threats continue to evolve and grow in sophistication, the importance of robust authentication mechanisms cannot be overstated. By integrating SMS OTP into their security frameworks, businesses can ensure secure and seamless interactions with their customers while staying ahead of evolving threats in the dynamic digital landscape.

In essence, SMS OTP serves as a linchpin in the quest for enhanced security and customer trust in today’s interconnected world. Its role in fortifying authentication processes, mitigating security risks, and fostering regulatory compliance underscores its enduring significance as a foundational element of modern cybersecurity strategies. As businesses continue to navigate the complexities of the digital age, SMS OTP stands as a beacon of reliability and security, empowering organizations to safeguard their assets and uphold the trust of their valued customers.