Managing cash flow can be a significant challenge for businesses, and one of the biggest obstacles is collecting overdue payments from clients. Traditional debt collection strategies, such as payment reminders, default judgments, and late payment notices, often result in high expenses and unreturned phone calls. However, there is a smarter and more cost-effective solution: SMS for debt collection.

The Power of SMS in Debt Collection

With the rise of text messaging platforms, debt collection agents can now automate payment reminders, personalize messages with account details, and follow up on payment confirmations. SMS services provide a range of applications that not only reduce collection costs but also respect the Debt Collection Practices Act. Here are some of the best ways debt collection agents can utilize SMS services:

1. Automate Payment Notifications

Instantly send payment reminders to debtors using SMS software. These reminders can help reduce collection costs and encourage customers to settle their debts promptly.

Example SMS template:

Dear {NAME}, we would like to remind you that the amount {SUM} was due for payment on {DUE DATE}. To avoid further costs, please forward the payment no later than {DATE}. Thank you, {COMPANY NAME}.

2. Inform Clients of Debt Collection Laws

Persuade clients to pay their debts by sending texts that provide information about debt collection laws. The goal is not to harass them but to help them understand the legal repercussions of overdue payments.

Example SMS template:

Hello {NAME}, the FTC & FDCPA prohibits debt collectors from using deceptive, unfair, or abusive practices to collect their debt from you. Don’t hesitate to contact us if you encounter any problems! {COMPANY NAME}.

3. Follow Up on Payment Confirmations

Maintain a positive relationship with customers by thanking them for completing a payment and offering continued customer service. This approach improves customer loyalty and satisfaction.

Example SMS template:

Dear {NAME}, your payment of {SUM} has been accepted, and your debt has been cleared. Thank you! If you’d like to turn on payment reminders for your account, reply with REMIND ME. Thank you, {COMPANY NAME}.

4. Schedule Payment Reminders

Prevent customers from forgetting to pay their debts by sending scheduled SMS reminders ahead of time. By scheduling weekly or daily reminders, you can ensure that they stay on top of their financial obligations.

Example SMS template:

Hey {NAME}! Your invoice of {SUM} has just been issued. You can review it at bit.ly/invoice-march. The amount is due by {DUE DATE}. Please complete the payment by then to avoid having your account restricted. {COMPANY NAME}.

5. Send SMS Messages with Account Details

Enhance clarity and transparency by sending personalized SMS messages to clients with comprehensive information about their accounts. By providing all the necessary tools and updates, you make it easier for customers to settle their debts.

Example SMS template:

Dear {NAME}, our system records show that you have an outstanding payment of {SUM}. You can securely pay online or turn on automatic payments by following our guide: bit.ly/automatic-payments. Thank you, {COMPANY NAME}.

6. Generate Auto-Responders for Common Inquiries

Simplify the process of answering common questions by setting up automated text replies. Assign keywords to frequently asked questions, such as payment plans, debt amounts, and interest rates, and the software will send automatic responses on your behalf.

Example SMS template:

Hello {NAME}! You are receiving this message due to a recent outstanding invoice of {SUM}. Unfortunately, the credit card on file could not be billed. Please give me a call at {NUMBER} if you require help with the payment. Thank you, {AGENT NAME}.

7. Monitor Communication Efficiency

Leverage bulk text messaging services that provide intuitive dashboards with metrics like delivery time, delivery status, response rate, and costs. Use this information to evaluate the effectiveness of your debt collection strategy and make necessary adjustments.

By utilizing these SMS strategies, debt collectors can harness the power of text messaging to improve collection rates, reduce costs, and maintain positive customer relationships. However, it’s important to use these tools responsibly and in compliance with debt collection regulations.

The Benefits of Overdue Payment Reminder SMS

Implementing overdue payment reminder SMS offers several advantages for debt collection efforts. Here are the key benefits of incorporating text messages into your debt collection strategy:

1. Higher Response Rates

Text messages have significantly higher open and read rates compared to phone calls and emails. Surveys have shown that text message open rates can range from 90 to 98 percent. By reaching out to customers through SMS, you increase the likelihood of getting a response.

2. Cost-Effectiveness

Traditional debt collection methods can be expensive, with high costs associated with phone calls and mailed letters. SMS provides a cost-effective alternative, saving your business money while still effectively communicating with debtors.

3. Instant and Direct Communication

SMS allows you to reach debtors instantly, delivering your message directly to their mobile devices. With nearly everyone quickly opening and reading text messages, you can ensure that your payment reminders are seen.

4. Improved Customer Relationships

Debt collection can be a stressful process for both parties involved. By utilizing polite and non-invasive SMS messages, you can maintain a positive relationship with your customers. This approach shows understanding and empathy, which can lead to increased customer loyalty and satisfaction.

5. Time-Saving Automation

Automated SMS solutions enable you to send messages to multiple customers simultaneously and automate responses to common inquiries. This saves time and resources, allowing your team to focus on more complex debt collection tasks.

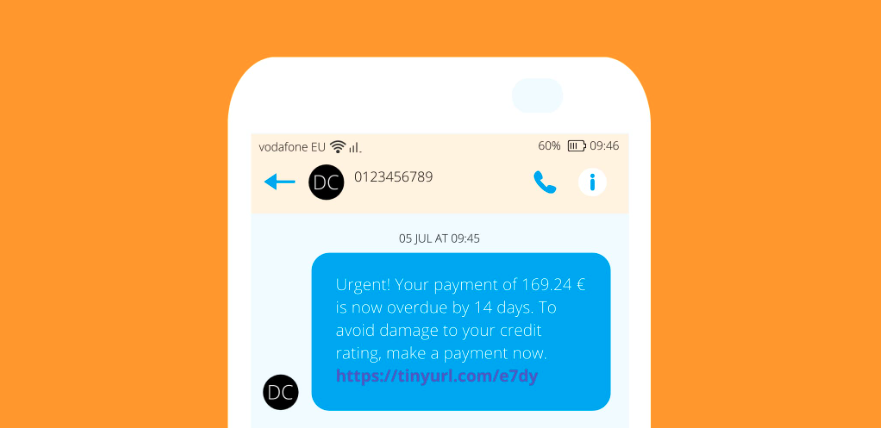

6. Sense of Urgency

Text reminders create a sense of urgency by including due dates and other essential information. By emphasizing the importance of timely payment, you encourage debtors to take immediate action.

It’s important to note that while SMS provides numerous benefits, debt collection agencies need to be mindful of potential drawbacks. Overwhelming customers with frequent messages or contacting individuals who genuinely cannot afford to make payments can be seen as intrusive and may damage your reputation. Striking the right balance and considering the individual circumstances of each debtor is crucial.

Staying Compliant with SMS Debt Collection

As with any communication method, debt collection agencies must prioritize compliance with relevant regulations. Here are some important considerations to ensure compliance when using SMS for debt collection:

1. Obtaining Consent

Before sending text messages, it is essential to obtain direct or indirect consent from the consumer. Direct consent can be obtained by requesting permission during a phone call or through an online form, while indirect consent can be obtained from the original creditor who already has the consumer’s consent. Debt collectors who follow specific procedures for obtaining consent may receive safe harbor protections.

2. Providing Opt-Out Options

Debt collectors must provide consumers with a clear and easy-to-use method to opt out of receiving text messages or other electronic communications. They must also promptly identify and honor opt-out requests, even if the consumer does not follow specific instructions.

3. Compliance with Harassment Guidelines

While there is no specific federal limit on the number of text messages debt collectors can send, it is crucial to adhere to the Fair Debt Collection Practices Act (FDCPA)’s rules regarding harassment and contacting consumers at convenient times. Sending texts between 8 a.m. and 9 p.m. local time is generally considered acceptable unless the consumer requests a different time.

4. Reconfirming Consent

Implied or expressed consent received from consumers is typically valid for 60 days. To continue texting a consumer beyond this period, debt collectors may need to have the consumer reconfirm their consent or ensure that the phone number has not been reassigned.

It is important to consult with legal counsel and stay informed about any changes in laws and regulations to ensure ongoing compliance with debt collection practices.

Conclusion

SMS for debt collection is a powerful tool that allows debt collectors to automate payment reminders, provide valuable information to debtors, and maintain positive customer relationships. By leveraging SMS services, debt collection agencies can improve collection rates, reduce costs, and streamline their operations. However, it is crucial to use these tools responsibly and in compliance with debt collection regulations. By following best practices and staying informed about legal requirements, debt collectors can effectively recover overdue payments while maintaining a respectful and professional approach.