OTP (One-Time Password) SMS (Short Message Service) plays a pivotal role in the banking sector, providing an extra layer of security for financial transactions and account access. In today’s digitally-driven world, where cyber threats loom large, OTP SMS stands as a shield against unauthorized access and fraudulent activities.

Introduction to OTP SMS

In the dynamic realm of banking, security stands as a paramount concern. In this landscape, OTP SMS emerges as a steadfast guardian, providing an extra layer of protection against unauthorized access and fraudulent activities. OTP, or One-Time Password, represents a unique code dispatched to users’ mobile phones, thereby guaranteeing that only authenticated individuals gain entry to their accounts or execute transactions. This article embarks on an exploration of the nuances of OTP SMS and its profound significance within the banking sector.

At its core, OTP SMS operates as a formidable barrier against unauthorized access attempts. By generating a unique code for each transaction or login attempt, OTP SMS mitigates the risks associated with password theft, phishing attacks, and other forms of cyber threats. The ephemeral nature of OTP codes ensures that they cannot be reused or intercepted, bolstering the security posture of banking systems and instilling confidence among users.

The adoption of OTP SMS represents a proactive response to the evolving landscape of cyber threats. As traditional authentication methods increasingly succumb to sophisticated hacking techniques, OTP SMS emerges as a resilient defense mechanism, adept at thwarting even the most determined adversaries. By leveraging the ubiquity of mobile phones and SMS technology, banks can deliver OTP codes swiftly and securely, fortifying their digital infrastructure against potential breaches.

Moreover, OTP SMS enhances user experience by striking a delicate balance between security and convenience. Unlike traditional security measures that rely solely on static passwords, OTP SMS introduces an additional layer of verification without imposing undue burdens on users. The seamless integration of OTP SMS into existing banking workflows ensures a frictionless authentication process, empowering users to safeguard their accounts with minimal effort.

How OTP SMS Works

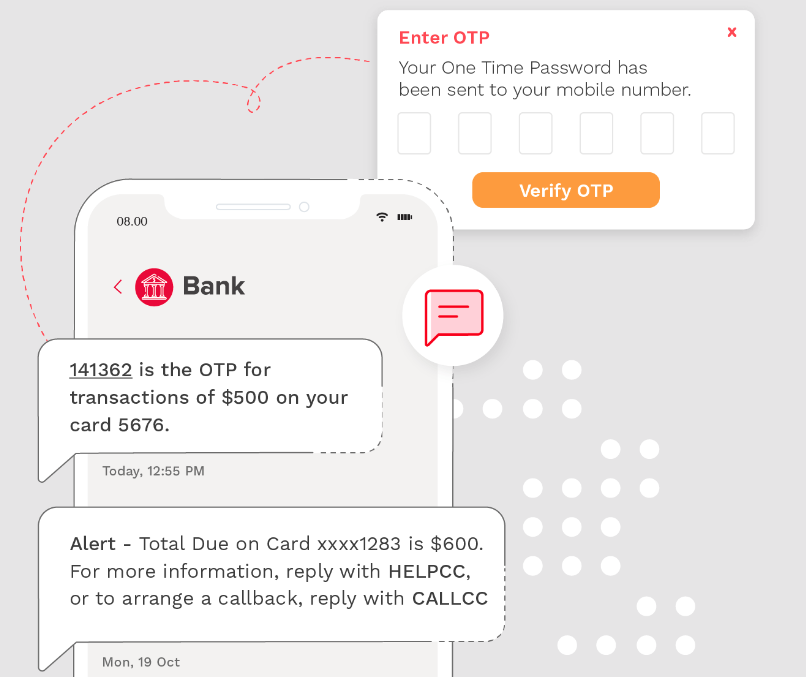

The process of One-Time Password (OTP) via Short Message Service (SMS) is a crucial mechanism employed by banking systems to ensure secure transactions and validate user identities. It initiates the generation of a unique code by the banking system, which serves as a single-use authentication credential. This code is meticulously crafted to be robust and unpredictable, typically generated using cryptographic algorithms or random number generators to thwart unauthorized access attempts.

Subsequently, the generated OTP code is dispatched to the user’s registered mobile number via diverse delivery mechanisms. These mechanisms primarily include SMS gateways or mobile networks, which serve as conduits for transmitting the OTP securely to the intended recipient. The reliance on SMS technology underscores its widespread accessibility and reliability, making it a preferred channel for OTP delivery across various banking systems globally.

Upon receipt of the OTP, the user engages with the banking system to authenticate their identity and authorize the intended transaction securely. This authentication process typically involves inputting the received OTP code into the designated authentication interface provided by the banking application or website. The OTP serves as a temporary and dynamic credential, valid only for a single transaction or session, thereby enhancing security by mitigating the risks associated with static passwords or credentials.

The interaction between the user and the banking system during OTP authentication encapsulates multifactor authentication principles, combining something the user knows (their credentials) with something they possess (their mobile device). This multifaceted approach fortifies the authentication process, rendering it more resilient against various cyber threats, including phishing attacks and credential theft.

The seamless integration of OTP via SMS underscores its pivotal role in bolstering the security posture of banking systems, fostering trust and confidence among users while facilitating secure digital transactions. As technology evolves, banking institutions continually refine and enhance their OTP mechanisms to adapt to emerging threats and uphold the integrity of their security frameworks. Consequently, OTP via SMS remains a cornerstone of modern authentication practices, safeguarding sensitive financial transactions and user data in an increasingly interconnected digital landscape.

Benefits of OTP SMS in Banking

The adoption of One-Time Password (OTP) SMS technology heralds a paradigm shift in banking security, offering a plethora of advantages for both financial institutions and customers alike. Foremost among these benefits is the bolstering of security measures through the integration of an additional layer of authentication. By leveraging OTP SMS, banks can substantially mitigate the risks associated with unauthorized access and financial fraud, safeguarding sensitive customer information and assets.

The essence of OTP SMS lies in its real-time functionality, which plays a pivotal role in enhancing the overall security infrastructure of banking systems. Unlike conventional authentication methods, OTP SMS ensures swift delivery of unique passwords to customers’ registered mobile devices, thereby fortifying the authentication process against potential threats such as phishing attacks and identity theft. This real-time verification mechanism not only deters malicious actors but also instills confidence among customers regarding the safety of their financial transactions.

Moreover, OTP SMS facilitates seamless and hassle-free banking experiences for customers by expediting the authentication process. With just a few taps on their mobile devices, customers can swiftly validate their identities and gain access to their accounts, thereby eliminating the need for cumbersome authentication procedures that may impede the user experience. This unparalleled convenience underscores the transformative potential of OTP SMS in revolutionizing the way customers interact with their banks, fostering greater efficiency and satisfaction in every transaction.

Furthermore, the adoption of OTP SMS underscores banks’ commitment to embracing cutting-edge technologies to safeguard their customers’ interests. By investing in robust authentication solutions such as OTP SMS, financial institutions demonstrate their unwavering dedication to upholding the highest standards of security and reliability in an increasingly digitized landscape. This proactive approach not only strengthens customer trust and loyalty but also reinforces banks’ competitive edge in an evolving marketplace characterized by escalating cybersecurity threats.

Challenges and Solutions

Despite its proven efficacy in enhancing security measures, OTP SMS technology is not without its challenges, which financial institutions must navigate to ensure its seamless integration into their banking systems. One of the foremost challenges encountered with OTP SMS is the issue of deliverability, which can arise due to various factors such as network disruptions or device compatibility issues. These impediments may result in delays or even non-receipt of OTPs, undermining the authentication process’s reliability and potentially inconveniencing customers.

Furthermore, OTP SMS faces inherent security concerns that necessitate robust countermeasures to mitigate risks effectively. Among these concerns, phishing attacks and social engineering tactics pose significant threats, exploiting vulnerabilities in OTP SMS systems to intercept or manipulate authentication codes for malicious purposes. Such nefarious activities undermine the integrity of OTP SMS as a secure authentication method, raising apprehensions among both banks and customers regarding the susceptibility of their transactions to fraudulent activities.

To address these challenges and uphold the integrity of OTP SMS as a secure authentication solution, banks employ a multifaceted approach encompassing advanced technologies and proactive strategies. One such strategy involves the implementation of multi-channel delivery systems, enabling customers to receive OTPs through alternative communication channels such as email or mobile applications. By diversifying the delivery mechanisms, banks can mitigate the impact of deliverability issues and enhance the reliability of OTP authentication processes.

Moreover, encryption techniques play a pivotal role in fortifying the security of OTP SMS systems against potential threats. By encrypting OTP messages and leveraging cryptographic protocols, banks can safeguard the confidentiality and integrity of authentication codes, thwarting attempts by malicious actors to intercept or tamper with sensitive information. Additionally, continuous monitoring and analysis of OTP SMS transactions enable banks to detect anomalous activities promptly, allowing for timely intervention and remediation to mitigate potential security breaches.

Regulatory Compliance

Regulatory compliance stands as a fundamental element in the implementation of One-Time Password (OTP) SMS services within the banking sector. Banks are obligated to uphold rigorous compliance standards, including the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and guidelines established by the Reserve Bank of India (RBI). These standards are paramount for safeguarding customer data and guaranteeing secure transactions in the banking environment. Failure to adhere to regulatory requirements can lead to significant penalties and substantial reputational harm for financial institutions.

The GDPR, enacted by the European Union, sets forth stringent rules for protecting the personal data of EU citizens. Banks operating globally or dealing with EU customers must ensure that their OTP SMS systems comply with GDPR provisions, ensuring the confidentiality, integrity, and lawful processing of customer data.

Similarly, adherence to PCI DSS standards is crucial for banks handling cardholder data during OTP SMS transactions. PCI DSS mandates robust security measures to protect sensitive payment information, reducing the risk of data breaches and fraudulent activities. Banks must implement encryption, access controls, and regular security assessments to maintain PCI DSS compliance.

In addition to international standards, banks in India must adhere to guidelines outlined by the RBI to ensure the security and integrity of banking operations. The RBI issues directives aimed at enhancing cybersecurity frameworks and mitigating risks associated with electronic transactions, including OTP SMS services. Banks must implement multi-factor authentication, data encryption, and real-time monitoring to align with RBI guidelines effectively.

Compliance with regulatory requirements demands ongoing efforts and investments in technology, infrastructure, and personnel training. Banks must continuously update their systems and processes to address evolving threats and regulatory changes effectively. By prioritizing regulatory compliance, banks not only mitigate legal and financial risks but also reinforce trust and confidence among customers regarding the security of their financial transactions and personal information.

Customer Experience Enhancement

Banks have long recognized the critical balance between security measures and customer experience, particularly in the realm of online transactions. One of the most prevalent tools in this regard is the One-Time Password (OTP) sent via Short Message Service (SMS). By leveraging OTP SMS, banks not only prioritize security but also enhance the overall customer experience.

The convenience factor inherent in OTP authentication plays a pivotal role in reducing friction during banking transactions. Instead of relying solely on static passwords, which are vulnerable to various forms of cyber threats, OTP SMS adds an extra layer of security. This dynamic code, sent directly to the customer’s mobile device, verifies the authenticity of the transaction in real-time, mitigating the risk of unauthorized access.

Moreover, OTP SMS instills a sense of confidence and trust among customers, as they perceive banks as proactive guardians of their financial well-being. This perception fosters customer loyalty and strengthens the bond between the bank and its clientele. Customers appreciate the proactive security measures implemented by banks, which align with their expectations of a secure and seamless banking experience.

In addition to enhancing security, soliciting user feedback and adapting OTP SMS systems based on customer insights further enriches the overall customer experience. Banks that actively seek feedback from their customers demonstrate a commitment to continuous improvement. By understanding customer preferences and pain points, banks can refine their OTP SMS systems to better align with customer needs and expectations.

Furthermore, customization options such as allowing customers to choose their preferred method of receiving OTPs, be it via SMS, email, or app notifications, add another layer of personalization to the banking experience. This flexibility not only accommodates diverse customer preferences but also reinforces the notion that the bank values and respects the individual choices of its clientele.

Case Studies

OTP SMS solutions have emerged as a potent tool in the arsenal of banks worldwide to fortify security measures and optimize banking operations. Through the implementation of One-Time Password (OTP) SMS, financial institutions have managed to address the growing concerns surrounding fraud and bolster customer confidence in digital transactions.

Across the globe, numerous case studies underscore the effectiveness of OTP SMS in combatting fraudulent activities while concurrently enhancing customer satisfaction. For instance, banks in regions like Europe, North America, and Asia-Pacific have reported tangible reductions in fraudulent incidents following the adoption of OTP SMS authentication mechanisms.

In these implementations, OTP SMS serves as a second layer of defense, providing customers with a unique, time-sensitive code delivered directly to their registered mobile devices. This code acts as a temporary credential, supplementing traditional login credentials and significantly reducing the risk of unauthorized access to accounts.

One notable benefit of OTP SMS solutions is their simplicity and ease of integration into existing banking infrastructures. Banks can seamlessly incorporate OTP SMS functionalities into their mobile banking applications or online platforms, ensuring a smooth user experience without compromising security standards.

Moreover, OTP SMS solutions have proven instrumental in mitigating various forms of fraud, including account takeover, identity theft, and unauthorized transactions. By requiring users to authenticate their identities through OTP codes, banks can thwart sophisticated phishing attacks and unauthorized access attempts, thus safeguarding sensitive financial information.

Furthermore, the implementation of OTP SMS has contributed to enhanced customer satisfaction and trust in banking services. Customers appreciate the additional layer of security provided by OTP SMS, which instills a sense of confidence in their digital interactions with financial institutions. As a result, banks have witnessed increased customer retention rates and improved brand loyalty.

Future Trends

The future of OTP SMS in the banking sector is poised for transformative advancements, driven by integration with cutting-edge technologies like biometrics, artificial intelligence (AI), and blockchain. These innovations hold immense promise in revolutionizing authentication mechanisms and fortifying defenses against evolving cyber threats.

Biometrics, encompassing fingerprint scanning, facial recognition, and iris detection, offers a secure and convenient alternative to traditional OTP SMS. By leveraging unique biological traits, biometric authentication ensures a higher level of identity verification, reducing the risk of unauthorized access and fraudulent activities.

Artificial intelligence presents another frontier in enhancing OTP SMS security. AI-powered algorithms can analyze user behavior patterns and transaction histories to detect anomalies and flag suspicious activities in real-time. Through continuous learning and adaptation, AI systems become increasingly adept at identifying potential threats, bolstering the resilience of OTP SMS authentication frameworks.

Furthermore, blockchain technology holds the potential to revolutionize the integrity and transparency of OTP SMS processes. By storing authentication data in decentralized and immutable ledgers, blockchain ensures tamper-proof records and enhances trust among banking institutions and their customers. The distributed nature of blockchain also mitigates the risk of single points of failure, enhancing the reliability and resilience of OTP SMS authentication systems.

In addition to strengthening security measures, the integration of these emerging technologies promises to enhance the user experience and streamline authentication processes. Biometric authentication offers a seamless and frictionless user journey, eliminating the need for manual input of OTP codes. AI-driven systems can personalize authentication mechanisms based on user preferences and behavior, further enhancing user satisfaction and engagement.

However, while the future of OTP SMS in banking holds great promise, it also presents challenges that must be addressed. Concerns surrounding data privacy, regulatory compliance, and interoperability of emerging technologies require careful consideration and collaboration among industry stakeholders.

Best Practices for Implementing OTP SMS

To maximize the benefits of OTP SMS, banks must adhere to a set of best practices aimed at enhancing security, ensuring compliance, and delivering seamless user experiences. Clear communication, provision of opt-out options, and regular updates are integral components of an effective OTP SMS strategy that mitigates security risks and fosters trust among customers.

Clear communication is paramount in establishing transparency and building confidence in OTP SMS authentication methods. Banks should articulate the purpose and benefits of OTP SMS to customers, emphasizing its role in safeguarding their accounts against unauthorized access and fraudulent activities. Providing clear instructions on how to opt-in and manage OTP SMS preferences enhances user understanding and encourages active participation in the authentication process.

Moreover, offering opt-out options empowers customers to tailor their authentication preferences according to their needs and preferences. While OTP SMS serves as a robust security measure, some users may prefer alternative authentication methods or opt-out due to personal preferences or privacy concerns. Banks should respect these choices and provide straightforward mechanisms for users to opt-out of OTP SMS without compromising account security.

Regular updates to OTP SMS systems are essential to stay ahead of evolving security threats and technological advancements. Banks should continuously evaluate the effectiveness of their OTP SMS solutions, incorporating industry best practices and emerging technologies to enhance security and usability. This includes implementing robust encryption protocols, monitoring for suspicious activities, and integrating advanced authentication mechanisms such as biometrics and AI-driven fraud detection.

Furthermore, banks must prioritize user experience in the design and implementation of OTP SMS systems. Seamless integration with existing banking applications, intuitive user interfaces, and minimal disruption to the customer journey are key considerations in optimizing the usability of OTP SMS authentication. Banks should solicit feedback from customers to identify pain points and areas for improvement, iteratively refining their OTP SMS solutions to deliver a frictionless user experience.

Comparison with Traditional Security Measures

One-Time Password (OTP) via SMS emerges as a formidable departure from conventional security methods such as passwords and security tokens. This dynamic authentication solution not only enhances security measures but also substantially mitigates the risks associated with account compromise and potential financial losses.

Unlike static passwords prone to brute-force attacks and token-based systems susceptible to interception, OTP SMS introduces a dynamic layer of security. Each time a user attempts to access their account, a unique, time-sensitive code is generated and sent directly to their registered mobile device via SMS. This real-time authentication mechanism significantly reduces the likelihood of unauthorized access, as the code becomes obsolete once used or upon expiration.

The strength of OTP SMS lies in its dynamic nature. Unlike static passwords susceptible to theft or token-based systems vulnerable to replay attacks, OTP SMS generates a new code with each login attempt, making it exceedingly challenging for malicious actors to gain unauthorized access. Moreover, the time-sensitive nature of these codes adds layer of security, as they expire within a short timeframe, further limiting their potential for exploitation.

Furthermore, OTP SMS offers unparalleled convenience for users. With no need to remember complex passwords or carry physical tokens, users can seamlessly authenticate their identities with a simple code sent directly to their mobile devices. This simplicity not only enhances user experience but also encourages widespread adoption of secure authentication practices.

From a financial perspective, the adoption of OTP SMS can translate into substantial cost savings for businesses. By reducing the risk of account compromise and potential financial losses resulting from fraudulent activities, organizations can safeguard their assets and uphold their reputation. Additionally, the implementation of OTP SMS can help businesses comply with regulatory requirements about data security and user privacy, thereby avoiding hefty fines and legal ramifications.

Integration with Emerging Technologies

The integration of One-Time Password (OTP) SMS with emerging technologies like the Internet of Things (IoT) and wearable devices is revolutionizing the landscape of secure banking experiences, tailored to meet the evolving demands of tech-savvy consumers.

In the realm of IoT, where devices are interconnected and communicate seamlessly, OTP SMS serves as an additional layer of security in financial transactions. IoT devices embedded with sensors and actuators can initiate transactions, trigger OTP requests, and authenticate users through SMS. For instance, smart home systems can request OTP verification before processing payments for utility bills or online purchases, ensuring that only authorized users can access and control financial transactions.

Wearable devices, including smartwatches and fitness trackers, have become integral parts of everyday life, offering convenience and accessibility. Integrating OTP SMS functionality into wearable devices allows users to receive OTP codes directly on their wrists, eliminating the need to retrieve codes from smartphones. This streamlined approach enhances user experience and ensures secure access to banking services on the go.

Moreover, the synergy between OTP SMS and emerging technologies enhances security measures against potential cyber threats such as phishing attacks and account takeover fraud. OTP codes delivered via SMS provide a dynamic layer of authentication, mitigating the risk of unauthorized access even if login credentials are compromised. By leveraging IoT and wearable devices to deliver OTP codes, banks, and financial institutions reinforce their security infrastructure and safeguard sensitive customer information.

Furthermore, the integration of OTP SMS with IoT and wearable devices aligns with the growing trend towards frictionless and personalized banking experiences. By leveraging the capabilities of connected devices, banks can deliver contextualized OTP authentication tailored to user preferences and behaviors. For example, OTP delivery mechanisms can be customized based on the user’s location, transaction history, and device preferences, enhancing user engagement while maintaining robust security protocols.

Cost-effectiveness Analysis

OTP SMS, or One-Time Password Short Message Service, emerges as a cost-effective solution that mitigates financial losses stemming from fraud and unauthorized access, despite incurring initial implementation costs. In today’s digital landscape, where security breaches and data compromises loom large, the significance of robust authentication measures cannot be overstated. OTP SMS stands as a formidable bulwark against such threats, offering a reliable mechanism to verify users’ identities securely.

Although implementing OTP SMS systems entails upfront expenses such as infrastructure setup, software integration, and ongoing maintenance, these investments pale in comparison to the potential losses incurred through fraudulent activities. The financial toll of data breaches, identity theft, and unauthorized access can wreak havoc on businesses, tarnishing reputations and eroding customer trust. Thus, adopting proactive measures like OTP SMS proves indispensable for safeguarding sensitive information and preserving financial integrity.

One of the primary advantages of OTP SMS lies in its simplicity and accessibility. By leveraging mobile devices, which have become ubiquitous in modern society, OTP SMS ensures seamless authentication experiences for users across diverse platforms and devices. Whether accessing online banking services, making transactions, or logging into secure portals, users can swiftly receive OTPs via SMS, fortifying the authentication process and thwarting potential intrusions.

Furthermore, OTP SMS offers a layer of dynamic security that transcends traditional static passwords. Unlike static credentials susceptible to brute force attacks and password guessing, OTPs generated through SMS are transient and time-bound, rendering them virtually impervious to malicious exploitation. This dynamic nature not only enhances security posture but also bolsters regulatory compliance, particularly in sectors governed by stringent data protection laws.

From a cost-benefit perspective, the long-term advantages of OTP SMS outweigh the initial investment outlay. By preempting fraudulent activities and deterring unauthorized access attempts, organizations can avert substantial financial losses, legal liabilities, and reputational damage. Moreover, the operational efficiencies gained through streamlined authentication processes contribute to overall cost savings and productivity gains over time.

Global Adoption and Variations

The adoption of One-Time Password (OTP) SMS authentication varies significantly across regions due to diverse cultural preferences and regulatory frameworks. This variance underscores the importance of understanding regional nuances for banks aiming to implement OTP SMS on a global scale.

In regions where mobile phones serve as ubiquitous communication tools, such as East Asia and parts of Africa, OTP SMS authentication enjoys relatively high adoption rates. In these areas, mobile phones are deeply ingrained in daily life, making OTP SMS a convenient and familiar method for securing transactions and accounts. Additionally, the prevalence of smartphones with text messaging capabilities further facilitates the use of OTP SMS.

Cultural preferences also play a significant role in the adoption of OTP SMS. In societies where trust in digital technology is high and reliance on formal banking systems is common, consumers may readily embrace OTP SMS as a secure authentication method. Conversely, in regions where traditional banking methods or face-to-face interactions are preferred, the adoption of OTP SMS may be slower due to skepticism or lack of familiarity with digital authentication methods.

Regulatory frameworks also influence the adoption of OTP SMS. In some jurisdictions, regulators mandate the use of OTP SMS as a security measure for online transactions to protect consumers from fraud and unauthorized access. Conversely, in regions where regulatory oversight is less stringent or where alternative authentication methods are deemed acceptable, banks may have more flexibility in implementing OTP SMS.

Furthermore, concerns regarding the reliability and security of OTP SMS have led some regions to explore alternative authentication methods, such as biometric authentication or hardware tokens. These alternatives may offer enhanced security and reliability compared to OTP SMS, particularly in environments where the risk of SIM card swapping or interception of SMS messages is high.

In conclusion, the adoption of OTP SMS authentication varies across regions due to a combination of cultural preferences and regulatory frameworks. To successfully implement OTP SMS on a global scale, banks must carefully consider these regional nuances and tailor their strategies accordingly, ensuring both security and user acceptance in diverse markets.

Case for Continuous Improvement

Continuous improvement is paramount in the implementation of One-Time Password (OTP) SMS by banks, as they leverage feedback loops and iterative enhancements to adapt to evolving security threats and changing customer preferences.

At the core of OTP SMS implementation is the recognition that security threats are dynamic and constantly evolving. Banks must remain vigilant and responsive to emerging threats such as phishing attacks, SIM card swapping, and SMS interception. By adopting a mindset of continuous improvement, banks can proactively identify vulnerabilities and strengthen their OTP SMS systems to mitigate risks effectively.

Feedback loops play a crucial role in the continuous improvement process. Banks actively solicit feedback from customers, security experts, and internal stakeholders to assess the effectiveness of their OTP SMS implementation. Customer feedback provides valuable insights into user experiences, usability issues, and areas for improvement. Security experts offer valuable perspectives on emerging threats and best practices for enhancing OTP SMS security. Internal stakeholders, including IT teams and compliance officers, contribute insights into technical feasibility and regulatory compliance.

Based on the feedback received, banks can iteratively enhance their OTP SMS implementation to address identified weaknesses and optimize performance. This may involve refining user interfaces to enhance usability, implementing additional security measures to mitigate emerging threats, or streamlining backend processes to improve efficiency. By adopting an agile approach to development and deployment, banks can quickly respond to feedback and adapt their OTP SMS systems to meet evolving security and customer requirements.

Furthermore, continuous improvement extends beyond technical enhancements to encompass broader strategic considerations. Banks must stay abreast of regulatory developments and industry trends to ensure compliance with evolving standards and best practices. They must also monitor competitor offerings and customer preferences to remain competitive in the marketplace.

In summary, continuous improvement lies at the heart of OTP SMS implementation for banks. By leveraging feedback loops and iterative enhancements, banks can adapt to changing security threats and customer preferences, enhancing the effectiveness and reliability of their OTP SMS systems while maintaining regulatory compliance and competitive positioning in the market.

Conclusion

In conclusion, OTP SMS (One-Time Password Short Message Service) emerges as a fundamental pillar of security and convenience within the banking sector, representing a crucial component in the realm of authentication mechanisms and customer experience enhancement. As technology continually evolves and threats in the digital landscape escalate, the significance of OTP SMS in fortifying financial transactions and securing sensitive data remains indispensable and ever more pronounced.

At the heart of its importance lies the unparalleled security it provides. OTP SMS serves as a robust shield against unauthorized access and fraudulent activities, offering an additional layer of protection beyond traditional passwords or PINs. By generating unique, time-sensitive codes sent directly to users’ mobile devices, OTP SMS ensures that only authorized individuals gain access to their accounts or perform critical transactions. This proactive approach to security not only mitigates the risks associated with account breaches but also fosters a sense of trust and reliability among banking customers.

Moreover, OTP SMS for the banking sector plays a pivotal role in enhancing the overall customer experience. Unlike cumbersome security measures that may impede the user journey, OTP SMS strikes a delicate balance between security and convenience. Its seamless integration into existing banking applications and platforms enables users to authenticate themselves swiftly and effortlessly, without compromising on security protocols. This streamlined authentication process not only minimizes friction points during account access but also reinforces the perception of the banking institution as technologically adept and customer-centric.

Furthermore, the ubiquity of mobile devices underscores the accessibility and reach of OTP SMS as a security tool. In an era where smartphones have become ubiquitous extensions of daily life, OTP SMS leverages this pervasive technology to deliver authentication codes directly to users, irrespective of their location or time zone. This ubiquitous accessibility not only caters to the needs of a diverse clientele but also ensures that security measures remain effective across a spectrum of devices and operating systems.

As the landscape of cybersecurity continues to evolve, OTP SMS remains at the forefront of innovation, adapting to emerging threats and evolving user preferences. The versatility of OTP SMS extends beyond traditional banking transactions, finding applications in diverse sectors such as e-commerce, healthcare, and telecommunications. Its adaptability to various use cases underscores its resilience and enduring relevance in an increasingly digitized world.

In essence, OTP SMS stands as more than just a security protocol; it embodies a commitment to safeguarding financial integrity and enhancing customer trust. As banking institutions navigate the complex terrain of cybersecurity, the role of OTP SMS as a cornerstone of security and convenience remains steadfast, ensuring that financial transactions are conducted with the utmost confidence and peace of mind. With its unwavering reliability and adaptability, OTP SMS continues to shape the future of secure banking in an ever-evolving digital landscape.